What is Agentic AI and Why Should Banks Care?

Agentic AI refers to artificial intelligence systems that autonomously perform tasks or ‘intents’ based on predefined objectives, continually adjusting actions in real-time to meet evolving customer needs. In the banking sector, this represents a shift from reactive systems – like traditional chatbots – to proactive action-oriented AI agents capable of task completion and complex decision-making.

Why does this matter in banking? As customer expectations rise and banks face the growing operational cost of large contact centers, they need AI that can handle more than just basic transactions. Agentic AI can autonomously manage complex banking processes like funds transfers, credit-card approvals, fraud detection, and customer inquiries—without requiring continuous human oversight. This evolution promises to significantly reduce operational burdens while improving the overall experience and increasing customer loyalty.

The Competitive Edge: Combining Agentic AI and Conversational AI for the Future of Banking Services

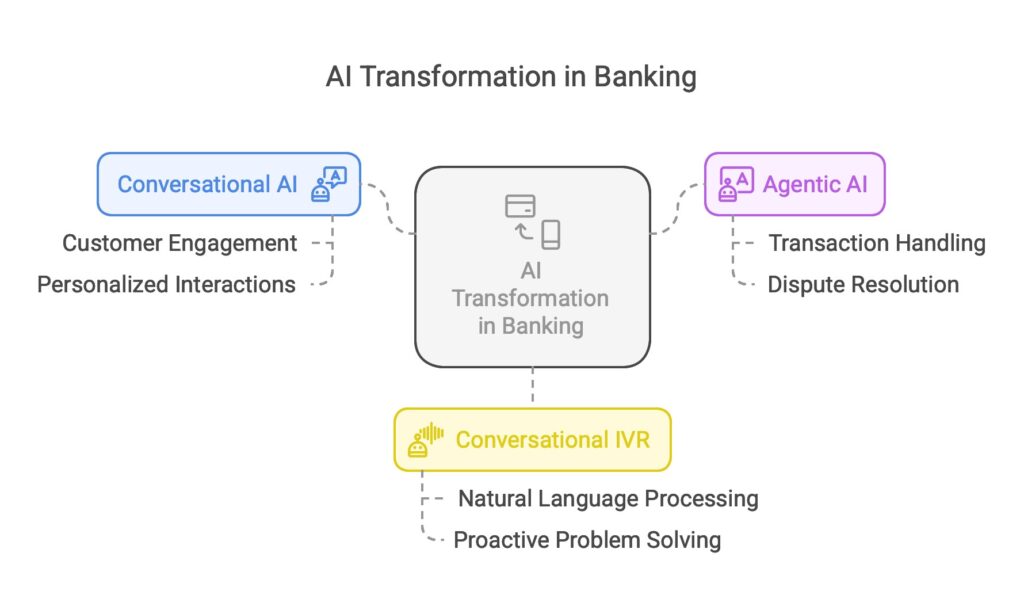

Agentic AI and Conversational AI are transforming banking across multiple digital channels, from customer-facing chatbots to replacing traditional IVR systems with voice-driven conversational IVR solutions.

Combining these AI capabilities enables banks to deliver seamless customer experiences where AI agents not only engage in meaningful conversations but also execute complex tasks autonomously, such as handling transactions, offering personalized financial advice, or resolving disputes. The result is a streamlined, efficient customer journey that reduces wait times, improves service quality, and enhances customer satisfaction.

How Does Conversational IVR Fit in with Agentic and Conversational AI?

Conversational IVR in banking is an advanced interactive voice response system that uses natural language processing (NLP) to engage customers in more human-like conversations. Unlike traditional menu-based IVR systems, conversational IVR allows customers to speak naturally, making inquiries or requests, such as checking balances, transferring funds, or resolving account issues.

This evolution, by leveraging Conversational AI along with Agentic AI, allows traditional IVR systems to become proactive problem solvers. Rather than just routing calls, this allows banks to position themselves as proactive partners in managing customer needs rather than simply being service providers.

Agentic AI in Banking: A Real-World Example

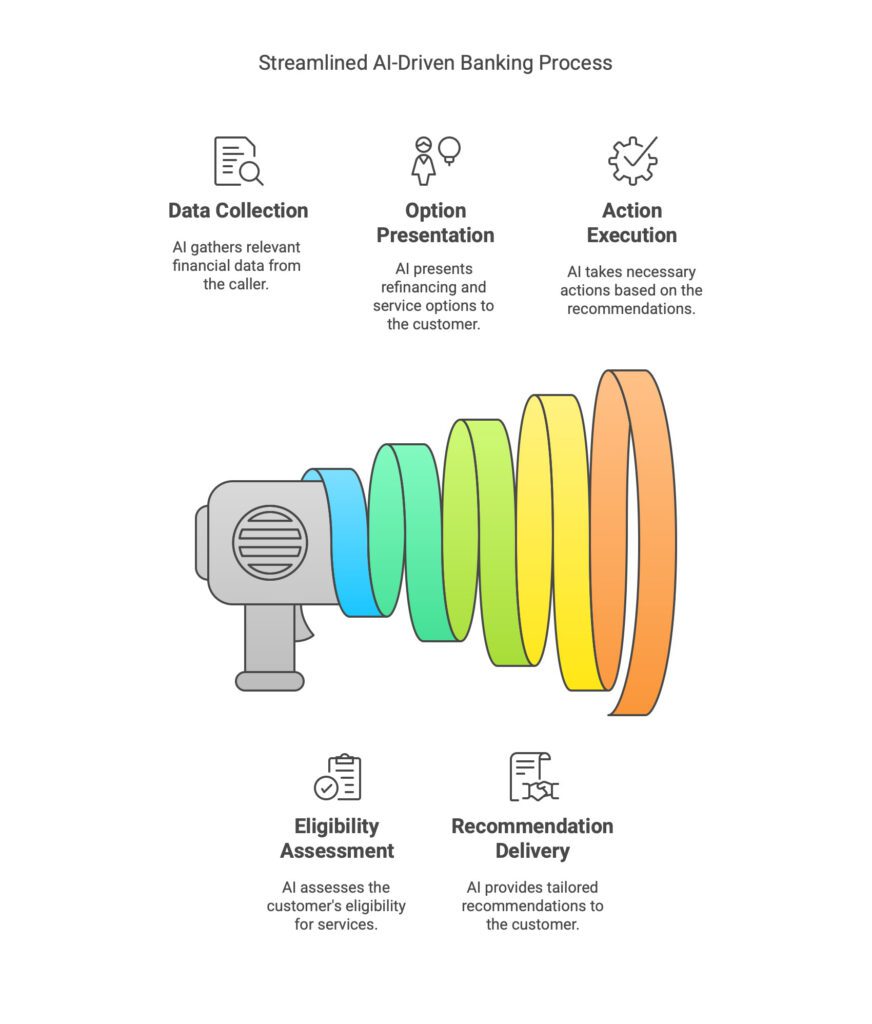

Consider a customer calling to inquire about mortgage refinancing. Rather than being routed through a traditional IVR system, a conversational AI agent preemptively gathers relevant financial data, assesses eligibility, and presents refinancing options—all during the call without requiring human interaction. This is where the combination of Agentic AI and Conversational AI shines. It can autonomously analyze financial information, provide tailored recommendations and take necessary action.

Additionally, banks are also using this AI combination to reduce call center volume by up to 30% to 40%. Imagine a system that handles common inquiries like checking balances or transfers, while also managing more complex, action-oriented tasks such as opening new accounts or guiding customers through investment strategies.

The system would understand and respond contextually, offering faster, more efficient service, reducing the need for customers to navigate complex menus, and improving overall customer experience—all while meeting strict compliance and security standards while the customer is on the phone.

This powerful synergy between Agentic AI and Conversational IVR drives personalized banking experiences and reduces operational costs, via a traditional digital channel, offering immense value to both banks and customers.

Summary: A Call to Action for Banks

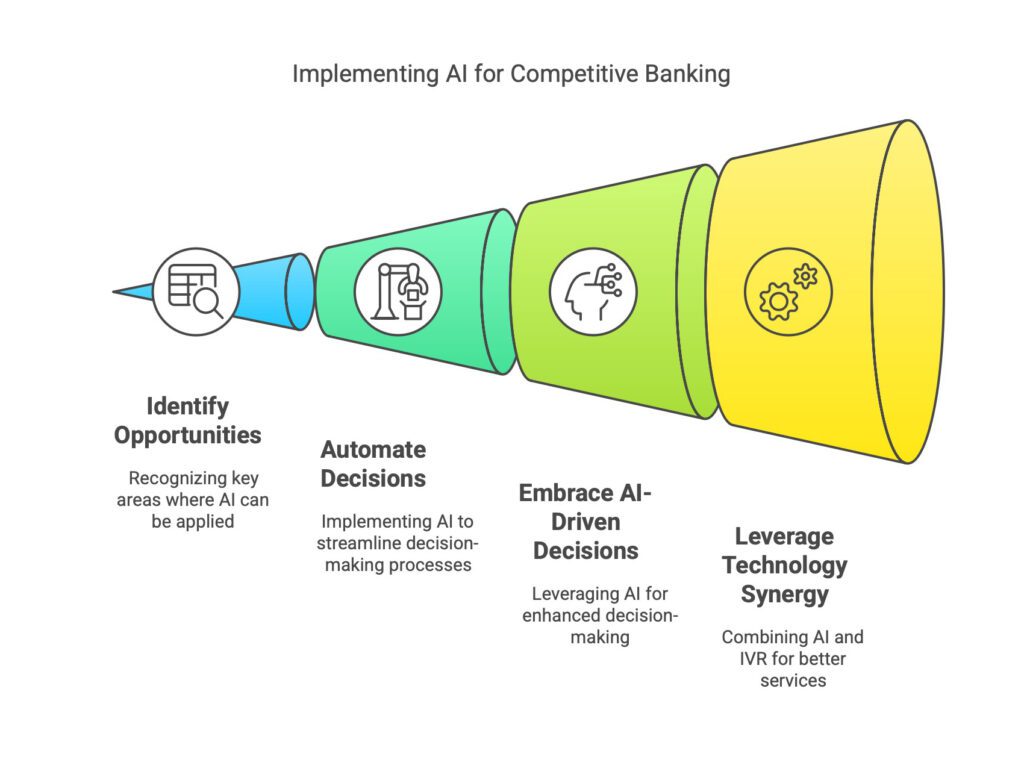

The question is no longer whether to adopt advanced AI technologies, but it’s rather how quickly banks can implement Agentic AI alongside Conversational IVR as a trusted digital channel to stay competitive in a rapidly evolving financial landscape. The path forward for banks lies in identifying critical areas of opportunity, automating decision-making processes, embracing AI-driven decision-making, and leveraging the synergy of these technologies to provide superior customer experiences and operational efficiencies.

At Cortico-X, we help financial institutions navigate the rapidly evolving AI landscape by turning insights into action. Whether it’s Agentic AI, Conversational IVR, or the next frontier of banking innovation, we work with organizations to design AI-driven experiences that enhance customer engagement, reduce operational friction, and drive measurable impact.

If you’re looking to explore how AI can redefine your customer experience strategy, let’s talk. And please consider following Cortico-X on LinkedIn for more insights on the future of banking and AI.

Rishi Thukral

As a Principal and Digital lead at Acquis Cortico-X, Rishi is an accomplished AI and Digital Innovation Leader with deep background and expertise in technology.