Summary

- Digital transformation creates a competitive convergence of hyper-personalized experiences at scale that reduces the tradeoff between tech and touch

- Hyper-personalization represents not just a strategy for developing greater overall customer experience, but as a way to monetize that customer experience more prominently

- However, hyper-personalization requires a maturation of customer-centric capabilities and infrastructure around data consumability, data quality, experimentation, technical infrastructure and AI fluency

The convergence of personalized “service” in banking is upon us. Back in the day banks originated and rose as local institutions to provide community financing based on an intimate relationship proximity to the customer. Fast forward to today, national and super-regional banks offer an array of products & services with the value proposition of scale and digital tools, but typically feels impersonal. Contrary, community banks and credit unions promote a higher level of personal touch with a ‘we know you better’ mentality, but customers lament lack of modern digital tools and processes. What does this means to the customer? A tech and touch tradeoff in experience where larger players “bank” on scale and smaller players on personal service.

But what if you can offer personalized service at scale? This is just not possible, it’s here. Big data, machine learning and artificial intelligence allow banks and credit unions to create new or modify existing products, services and experiences that is individualized across the gamut of customers in real-time. In other words, digital transformation allows for hyper-personalization at scale.

This represents a convergence of value propositions between larger banks and smaller community banks and credit unions. The financial wellbeing-based experiential outcomes, discussed in The Emotional Disconnect: The Lens to Hyper-Personalization in Banking, can be translated in a digital format directly to customers and/or augment employee behavior using instantaneous data intelligence and signals.

Monetizing the Customer Experience

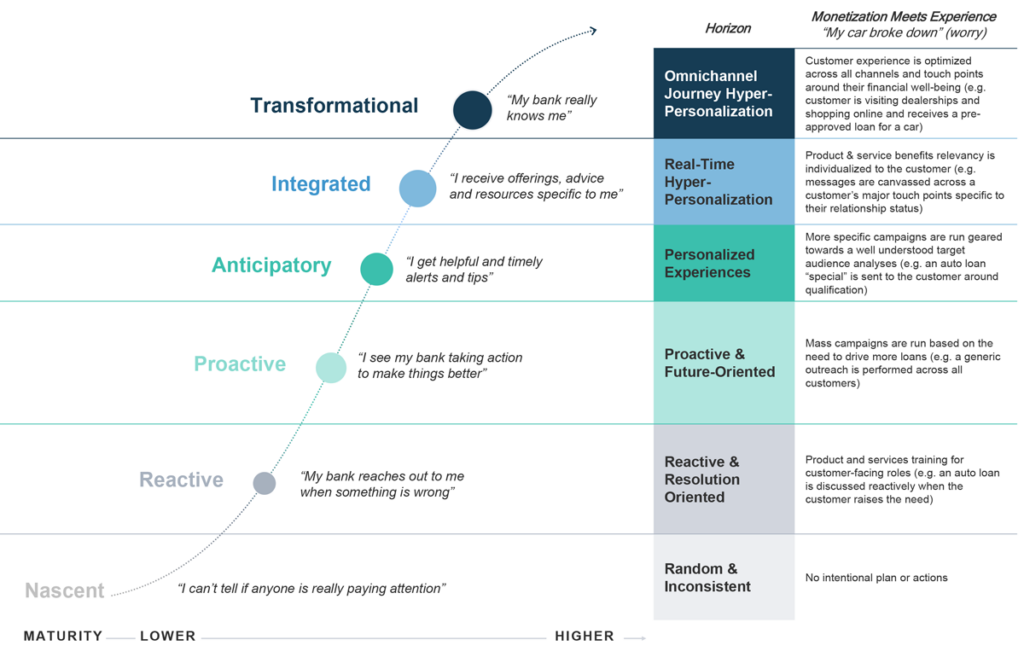

Leaders of banks and credit unions should not view this as interesting conjecture, but a call to action to accelerate the pace of change along the Hyper-Personalization Maturity Path. In banking, hyper-personalization represents not just a strategy for developing greater overall customer experience, but as a way to monetize that customer experience more prominently.

Unlike other industries, such as hospitality or retail, a great experience does not as easily translate to earning more business. For example, just because a customer might feel their bank has a best-in-class mobile user experience that does not mean they will go with that same bank for their next mortgage or even recommend others to do so. A seamless and resonant customer experience may earn you the right, but banks and credit unions must capitalize on that affection into monetizable moments.

HYPER-PERSONALIZATION MATURITY PATH

ACROSS DESIRED CUSTOMER EMOTIONAL OUTCOMES

Those banks and credit unions who can move through the horizons of maturing their hyper-personalization capabilities stand to not only win hearts and minds, but also win new customers, deposits and overall share of wallet. BCG studies have shown that personalization in banking can lower rates of user churn and increase sales, leading to annual revenue uplifts of 10%. Through hyper-personalization, experience and business outcomes have never been more intractably linked.

Easier Said Than Done

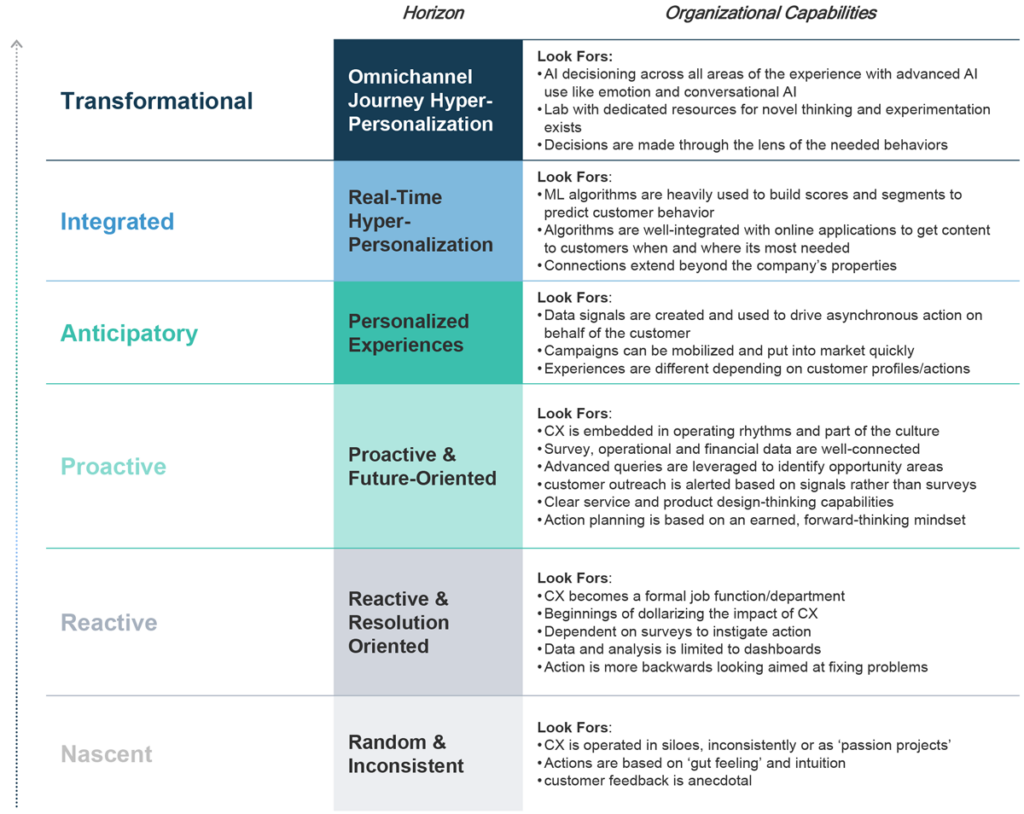

Advancing and ultimately monetizing the customer experience will be a function of how well data, technology and people can be threaded together to increase relevancy with customers at any given moment in their lives. Key organizational capabilities are required in order to advance along the Hyper-Personalization Maturity Path.

KEY ORGANIZATIONAL CAPABILITIES

BY MATURITY HORIZON

The reality is banks and credit unions face several significant hurdles in their advancement to even demonstrate (let alone scale) a true hyper-personalized customer experience. A report titled Maximizing Digital Engagement, co-produced by Infosys Finacle and Qorus, revealed that while 71% of banks are running personalized campaigns and communications, less than 50% are leveraging crucial capabilities such as enterprise customer data management, proactive advice, data-driven micro-segmentation, and AI and ML recommendations.

From working with financial institutions, large and small, on this very topic, we offer 5 major pieces of advice based on the common challenges those organizations face:

1. End Consumption: Think User Stories

In a recent CDO Agenda 2024 report lead by Tom Davenport and sponsored by AWS, cited that when (Chief Data Officers) were asked what they find the greatest challenges to realizing the full potential of Generative AI, “finding the right use cases” was ranked second. We encourage organizations to elevate their thinking beyond functional use cases to a higher altitude of desired experience.

A desired experience can be written as a ‘user story’, which is a brief narrative around a need that has an outcome. For example, “I want to accurately risk score segments not traditionally served by us to expand our customer base” or “I want to sequence the right advice, resource and offerings to our customers to make them feel we have their backs”.

Taking an experience-led view allows banks and credit unions to deeply understand customer needs and behaviors, prioritizing the development of solutions that directly address specific pain points and create tangible business value.

2. Data Quality: Focus on the 10-15% of Data that Adds 80% of the Value

In the same CDO Agenda 2024 report nearly half (46%) of CDOs pointed to data quality as the top challenge to succeeding with Generative AI. In fact, a 2023 Accenture “Banking Consumer Study” highlights that only 53% of respondents reported that their organization can realistically achieve a unified view of their customers through accurate and accessible data.

Sure, your data looks more like a swamp than a lake, but guess what? So does everyone else’s. The truth is that what most might consider to be the most data sophisticated organizations don’t have it all architected perfectly either – they have the same messes you do – but they choose to focus on the most critical data assets that that are foundational to driving the user stories mentioned above.

In this respect, organizations are maturing their data management and governance capabilities through the lens of business value versus trying to fix everything in a bottoms-up fashion that takes years upon years to address, if ever.

3. Technical Infrastructure: Transform Data into a Signals Marketplace

A flexible data infrastructure enables the rapid collection, integration, and analysis of diverse data sources, facilitating the creation of real-time, personalized customer experiences. The concept of a signals marketplace is particularly relevant here. By centralizing and standardizing data into a marketplace of signals (different than a DataMart), organizations can orchestrate these signals to deliver highly tailored offerings. As highlighted in McKinsey’s article “What is personalization?“, this approach empowers businesses to move beyond simple customer segmentation and create truly personalized experiences.

This opens the aperture for the organization to use AI (beyond ChatGPT) to enhance its personalization offering. With trusted data, and flexible technology, AI can rapidly analyze and uncover hidden patterns and generate near real-time insights.

4. Experimentation: Think Big, Start Small & Scale Fast

Rapid prototyping and testing are key to succeed in the hyper-personalization space. An incremental approach often involves gradual changes, which can be slow and inefficient. By thinking big, organizations set a North Star that can truly deliver a differentiated experience to their customers. This allows them to determine the path and investment needed, as well as the go-to-market strategies they should adopt to quickly validate the effectiveness of their personalization strategies.

Once validated, successful initiatives can be scaled across the broader customer base, driving significant business impact. As BCG emphasizes in their report, Think Big, Start Small, Scale Fast, this approach enables organizations to maximize the value of their data and technology investments while minimizing risks.

5. Fluency: Establish a Common Understanding of AI

Although a customer-centric culture that prioritizes innovation and experimentation is essential for hyper-personalization, our experience has revealed driving organizational alignment across senior leadership (and Boards) is a formidable cultural barrier. At the root, much of this we find is strikingly foundational.

The varied level of understanding of AI and emerging technologies amongst leadership teams hurts strategic alignment and thereby dampens pace of change and underestimates what it will really take. Rik Reppe, Head of Cortico-X’s Innovation Practice, laments in Cortico-Xplorations: Reclaiming the Strategic Agenda in the AI Era that “the AI knowledge gap between young, emerging talent and current executives is widening, with the youngsters knowing considerably more about AI than executives”.

Establishing a baseline of AI fluency is essential to drive successful customer hyper-personalization initiatives. This fluency equips leaders with the knowledge to understand, advocate and make more informed-decisions across data maturity, technology investments, resource allocation and experimentation. Ultimately, when senior leaders are fluent in AI and emerging technologies, they can not only champion exceptional, personalized experiences, but also position organizational capabilities needed to deliver.

Check out our new series, Gambling on the Future and the Sacrifice for Stability, of a newly launched Human Insights & Our Relationship with Money series that seeks to understand the underlying drivers of people’s emotional relationship with money that allow us to explore how the financial industry can adapt to those changing needs of people today.

Anson Vuong

is the Vice President of Cortico-X's Financial Services practice.

Anand Balasubramanian

leads Cortico-X's Data Practice with 20+ years of experience helping organizations transform their data into human-centered data products.