Summary

- The rapid shift to digital banking and increased accessibility to personal data will only increase the prevalence of fraud and downstream friction in the customer experience

- An “experience-led fraud approach” in banking is needed to balance the tensions between tighter fraud controls and a desired frictionless customer experience

- This approach pushes the reimagination of certain employee, technical and data architectures in order to start from the premise that customers are good actors until proven otherwise

In banking, the most transformative feeling a customer can experience is the feeling that their bank or credit union looks out for their financial well-being. This sentiment is often shaped by high-stake memory loading events, particularly the fraud experience. While customers expect their banks and credit unions to establish robust controls and safeguards to protect their identities and relationships, they simultaneously desire a frictionless experience when verifying their identity and completing transactions. Banks and credit unions must navigate these often-conflicting expectations through what we term an “experience-led fraud approach”.

The Fraud Landscape

Fraud has emerged as one of the most rampant challenges in the customer experience. In Alloy’s 2024 State of Fraud Benchmark Report, over two-thirds of decision-makers in fraud-related roles at financial services organizations reported an increase in the number of fraud attempts in consumer accounts over the past 12 months. The prevalence of fraud is expected to continue get worse, driven by three main forces:

- Shift to Digital Interactions: As customer interactions shift from human interactions to digital platforms, new vulnerabilities arise, creating more opportunities for fraud.

- Access to More Data: These digital interactions generate vastly more amounts of accessible data about the customer, which can be exploited in fraudulent schemes.

- Rapid Digital Banking Growth: The acceleration of digital banking services, particularly following the COVID-19 pandemic, has outpaced the capabilities of existing fraud controls, leaving banks in catch-up mode to handle the evolving landscape.

As a result, banks and credit unions have been compelled to implement more stringent fraud controls to circumvent losses. However, this has led to higher friction in the customer experience, resulting in frustration and abandonment of services. According an abandonment study published by Cornerstone Advisors, among the institutions that offer digital account opening for deposit products, banking executives cited that challenges related to background checks and authentication were the top two leading reasons for a high rate of digital account opening abandonment, where one-third saw between 26% and 50% of applications abandoned while a quarter had more than half of applications abandoned. The cumulative effect of increased verification layers has left customers fatigued and increasingly dissatisfied with their digital experiences.

An Experience-Led Fraud Approach

Traditionally, banks and credit unions have managed fraud with a focus on minimizing losses, often overlooking the downstream effects on the end experience. This approach is inadequate today, especially for business and channel leaders within banks trying to win the hearts and minds of the younger customer demographic. A Gartner and Forrester study finds that 85% of consumers are willing to switch from well-established brands to newer, challenger brands if they’re provided with a superior experience. The younger customer demographic exhibits less tolerance for cumbersome digital interactions and is more inclined to explore alternative banking options, even if they have limited information about them.

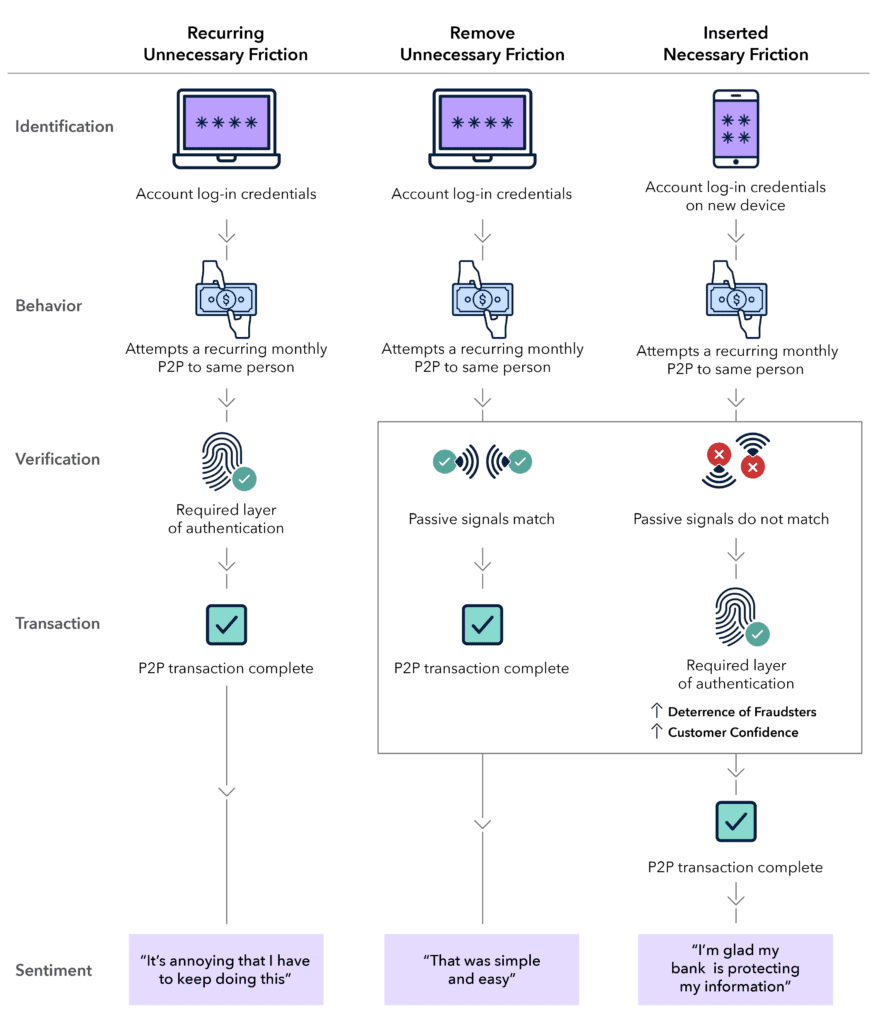

This calls for banks and credit unions to seek-out opportunities to passively gain confidence in customer identities, casting a wider net of data signals to determine real vs. suspicious, and only inserting friction where it is most effective. In other words, banking leaders must balance the experience-fraud relationship. Instead of looking at the core flows and vectors that contain fraud ubiquitously, an experience-led fraud approach seeks to also view fraud through the customer experience. This customer-centric lens first assumes you are a good actor until proven otherwise vs. the traditional lens which assumes you are a bad actor until you prove you are not.

For example, if at the time of login, the bank or credit union has gathered enough passive signals to determine that the customer is “good” and is “who they say they are” – get them to an experience that leans towards their most commonly done task with the least / minimal amount of clicks. Making them always go through 2FA or challenge questions at login creates unnecessary friction.

However, when identity elements change (e.g., when the customer gets a new phone that has never been used before and tries to login – insert the 2FA since this was detected, so the customer also gets the confidence that the bank or credit union has security controls in place to ensure that customer’s information is protected.

Balancing the Equation

For banking leaders, implementing an experience-led fraud approach may seem monumental—where do you even start? However, by ‘going wide to then go narrow’, leaders can effectively understand where to take action through five core workstreams:

- Map the Experience: Begin by mapping the end-to-end fraud experience from the customer’s viewpoint. Typically, this involves determining and prioritizing the ‘jobs to be done’ on what the person behind the customer is trying to get done and where that interlays with common entry points of fraud, such account origination, account log-in, conducting a transaction, modifying account information or closing a relationship.

- Identify Your Fields of Play: Determine the business use cases where friction is causing the most significant adverse impacts on customer sentiment and business outcomes. These areas become the ‘fields of play’ where banks and credit unions can focus their efforts.

- Unpack the “System”: Once the fields of play are identified and prioritized, work backward to blueprint the underlying employee, technical, and data architectures. Recognize that the existing system is producing the outcomes it was designed to generate.

- Reimagine Key Components: Explore opportunities to innovate within the system’s core components. This often involves addressing data voids or developing more sophisticated data signals to enhance fraud detection.

- Test It & Calibrate: Implement and test the reimagined approaches to ensure they effectively balance customer experience with fraud prevention.

By embracing an experience-led fraud approach, banking leaders can create a complementary perspective to traditional fraud management strategies. This mindset shift will enable them to identify use cases and opportunities that harmonize customer experience with the imperative of fraud prevention, ultimately fostering a safer and seamless experience.

Are you ready to turn insights into action? The Cortico-X team specializes in helping clients enhance customer experiences and drive growth by addressing challenges like these head-on. Reach out to us today, and let’s explore how we can elevate your strategy together.

Anson Vuong

is the Vice President of Cortico-X's Financial Services practice.

Hrishi Talwar

is an Identity & Fraud Advisor to Cortico-X with 15+ years of experience in the space.